Technology

How to Stop Discord From Opening On Startup – Full Guide

So you Might Be wondering how to stop discord from opening on startup ? Well, we have got that covered for you. For most of the people, it is really annoying that when you switch ON your PC. A large set of Resource consuming Programs auto-starts and discord is one of them. Here is an entire guide on how to disable discord from starting up on WIndows Bootup.

How to Stop Discord From Opening On Startup

30 mins 30 minutes

-

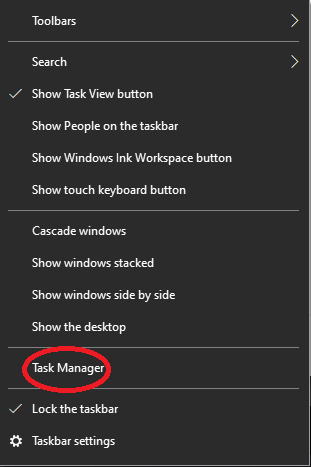

Start Task Manager

Go to the Taskbar and right click on it. A list of options will pop-up. Click on Start Task Manager to run it.

-

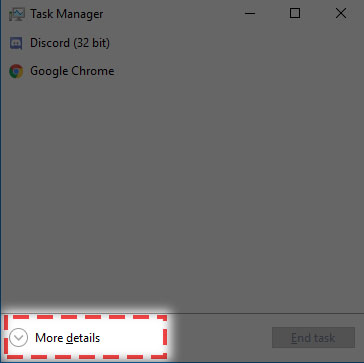

Select More Details

When the Task Manager opens up , it will be in a collapsed state. Click More Details to Expand it.

-

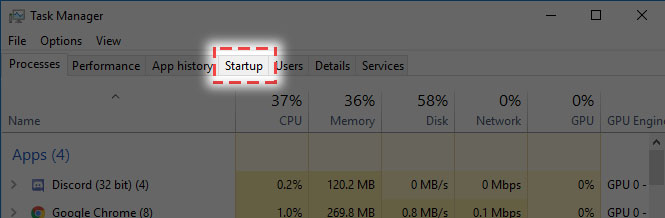

Choose the Startup Tab

Hover your mouse over to the top section of the Task manager , where you can find the Startup Option and Click on it.

-

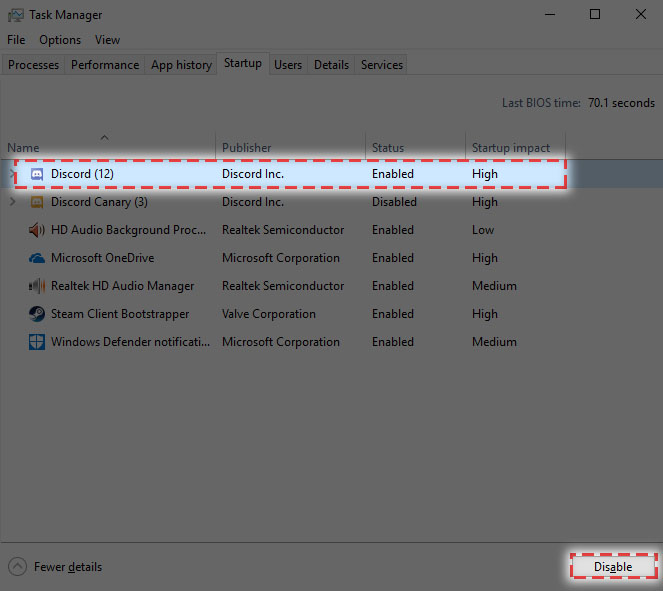

Disable Discord

The last and final step involves disabling discord program. Right Click on Discord and Click Disable option. That’s it , discord is now disabled on your PC.

Now you might be wondering whether there is another way on How to Stop Discord From Opening On Startup? Well the answer is Yes, check the Procedures Below.

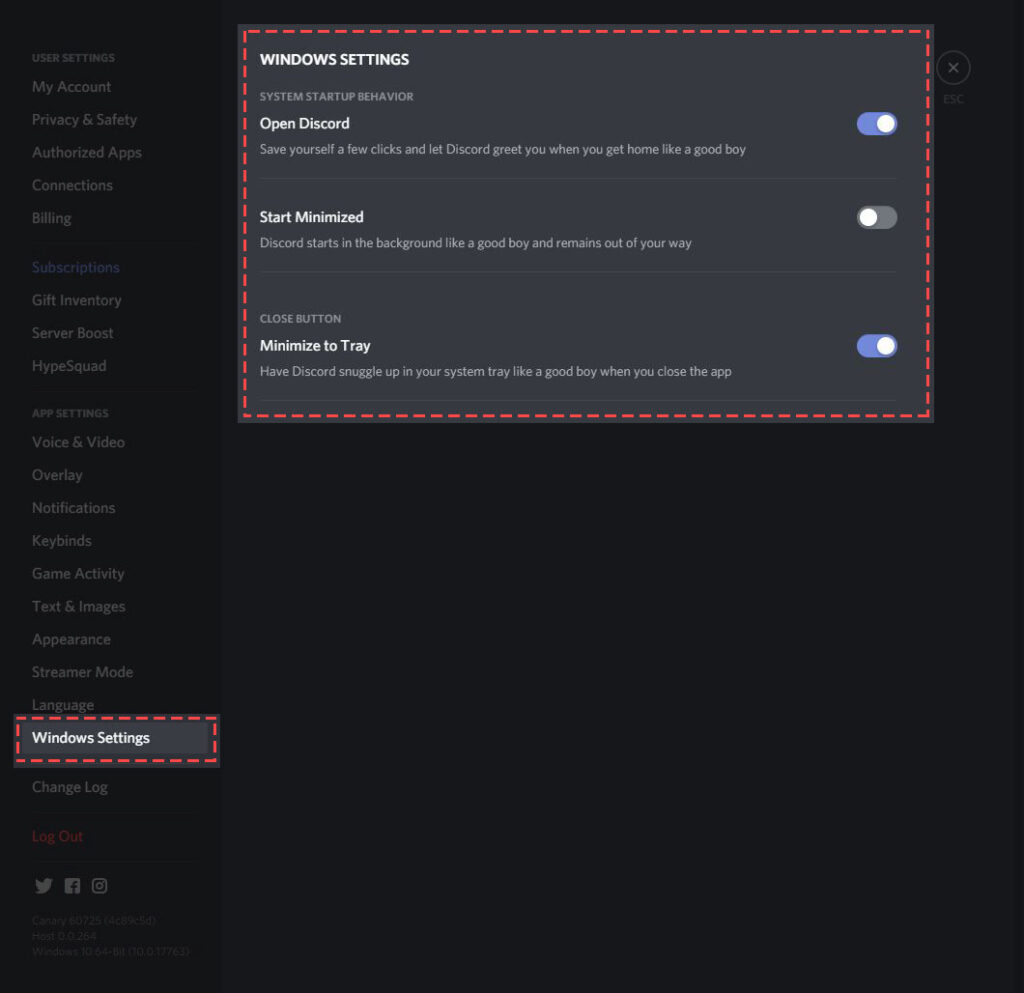

Alternative way on How to Stop Discord From Opening On Startup

1. Open Discord App

2. Click User Settings and Go to Windows Settings

3. Toggle the Open Discord Slider to Off

Technology

Peering Through the Apple Vision Pro: A New Perspective on Smart Glasses

Discover the Future of Sight: Apple Vision Pro Unveils a Revolutionary Leap in Smart Glasses Technology and Augmented Reality Wearables.

Peering through the lens of the Apple Vision Pro, one is transported into a realm where smart glasses technology merges seamlessly with everyday life, offering a glimpse into the future of augmented reality wearables. This review will explore the intricate weave of innovation that Apple has spun into its smart eyewear, providing an insightful analysis of how these AR glasses stand to redefine our interaction with the digital world. As we explore the features, design, and user experience of the Apple Vision Pro, we invite you to join us in discovering how this cutting-edge technology could alter the fabric of our technological interactions and open up new vistas of possibility.

Table of Contents

- Unveiling the Apple Vision Pro: A Comprehensive Review

- The Evolution of Smart Glasses Technology: Where Does Apple Stand?

- Navigating the World with Augmented Reality Wearables: The Apple Vision Pro Experience

- Apple Smart Eyewear: Blending Style with Cutting-Edge Functionality

- Innovations in AR Glasses: How the Apple Vision Pro is Redefining the Genre

- How does the Apple Vision Pro enhance everyday experiences with augmented reality wearables?

- What are the standout features of the Apple Smart Eyewear in comparison to other smart glasses on the market?

- Can the Apple Vision Pro smart glasses technology replace traditional devices like smartphones or tablets?

- How has innovations in AR glasses been pushed forward by the release of Apple Vision Pro?

- What do reviews generally say about the user experience of the Apple Vision Pro?

- Conclusion

Unveiling the Apple Vision Pro: A Comprehensive Review

The Apple Vision Pro emerges as a beacon of innovation in the burgeoning field of smart glasses technology. Its sleek design belies the powerful technology housed within its frames. The high-resolution displays integrated into each lens offer users a crisp and vibrant view of their augmented world, with minimal intrusion into their field of vision. The responsive touchpad located on the side arms allows for intuitive control, ensuring that users can navigate through menus and applications with ease.Audio innovation is another standout feature, with spatial audio capabilities that create an immersive sound experience without the need for earphones. This not only enhances privacy but also maintains a connection with the environment. The Apple Vision Pro’s voice control is underpinned by Siri, which has been refined to understand context and nuance better than ever before.Battery life is a common concern with wearable technology, but the Apple Vision Pro addresses this with an all-day battery that supports wireless charging. This commitment to longevity ensures that users can rely on their smart glasses throughout their daily activities without fear of losing connection to their digital lives.

The Evolution of Smart Glasses Technology: Where Does Apple Stand?

Apple’s foray into smart glasses technology did not happen in isolation. The sector has seen various iterations and improvements over the years, with numerous companies attempting to strike a balance between functionality and wearability. However, where Apple stands out is in its dedication to refining these aspects to near perfection.The Apple Vision Pro builds upon lessons learned from earlier attempts by competitors, integrating advanced AR capabilities while maintaining a form factor that is both comfortable and stylish. This evolution is marked by Apple’s use of custom chipsets that optimise performance while conserving power, a critical factor in wearable tech.Moreover, Apple’s robust ecosystem allows for seamless integration with other devices, enhancing the utility of the Vision Pro. Whether it’s picking up a call from your iPhone or receiving turn-by-turn navigation from Maps, the interoperability is smooth and intuitive. This synergy between devices is not just convenient; it’s transformative, allowing users to stay connected in ways previously unimagined.

Navigating through your day-to-day life with the Apple Vision Pro offers an unparalleled experience. Augmented reality overlays digital information onto the physical world, and with the Vision Pro, this technology reaches new heights of clarity and relevance. Imagine walking down the street and seeing directional arrows on the pavement, guiding you to your destination, or looking at a restaurant and instantly viewing its menu and ratings.The potential for professional use is equally impressive. Architects could visualise buildings within a real-world context, while surgeons could have vital statistics and imaging displayed right before their eyes during procedures. The applications are as varied as they are groundbreaking.Privacy concerns are paramount when it comes to AR wearables, and Apple addresses this by implementing sophisticated data protection measures. Users can trust that their information is secure and that they have control over what they share and when.

Apple Smart Eyewear: Blending Style with Cutting-Edge Functionality

Apple has always placed a premium on design, and the Vision Pro smart eyewear is no exception. These glasses don’t just serve as a portal to augmented reality; they’re also a fashion statement. Available in various styles and finishes, they can complement any look, from business casual to evening chic.The materials used are lightweight yet durable, ensuring comfort during extended wear while also standing up to the rigours of daily use. The attention to detail extends to the lenses themselves, which are treated to be scratch-resistant and anti-reflective.But style does not come at the expense of functionality. Each pair is equipped with advanced sensors that detect gestures and eye movements, allowing users to interact with their device in a way that feels natural and unobtrusive. This harmony between form and function sets a new standard for what smart eyewear can be.

Innovations in AR Glasses: How the Apple Vision Pro is Redefining the Genre

The innovations present in the Apple Vision Pro mark a significant leap forward for AR glasses. One of the most notable advancements is in the realm of personalised experiences. The Vision Pro uses machine learning to understand user preferences and habits, tailoring notifications and content to suit individual needs.The environmental awareness of the device is another groundbreaking feature. Using LiDAR technology, the glasses can map surroundings in real-time, allowing for more accurate and responsive AR interactions. This not only improves user experience but also opens up new possibilities for app developers to create rich, immersive applications that interact with the world around us.Lastly, health monitoring capabilities have been subtly integrated into the design. The Vision Pro can track metrics such as heart rate and steps taken, encouraging users to stay active and mindful of their wellness. These health features blend seamlessly into the overall experience, reinforcing Apple’s commitment to enhancing lives through technology.

How does the Apple Vision Pro enhance everyday experiences with augmented reality wearables?

The Apple Vision Pro smart glasses are designed to seamlessly integrate augmented reality into daily life. By projecting information directly into the user’s field of vision these glasses allow for real-time interaction with notifications navigation and multimedia content without the need to look away from what you’re doing. Imagine walking down the street and getting turn-by-turn directions overlaid onto the real world or viewing a recipe right in front of your eyes while cooking. The hands-free convenience and immersive experience offered by the Apple Vision Pro make it a significant step forward in augmented reality wearables.

What are the standout features of the Apple Smart Eyewear in comparison to other smart glasses on the market?

Apple’s foray into smart eyewear with the Vision Pro brings several standout features that set it apart from competitors. One of the most talked-about features is its advanced retina display which offers crisp and vibrant visuals without being intrusive. Additionally the integration with Apple’s ecosystem allows for a seamless connection with other Apple devices enhancing functionality and user experience. The glasses also boast a sleek design that aligns with Apple’s aesthetic making them not only technologically advanced but also fashion-forward. Battery life and privacy features are also areas where the Apple Vision Pro outshines others offering users peace of mind and extended use throughout their day.

Can the Apple Vision Pro smart glasses technology replace traditional devices like smartphones or tablets?

While the Apple Vision Pro smart glasses offer an array of functionalities that overlap with smartphones and tablets they are not intended to replace these devices completely. Instead they complement them by providing an alternative way to access information and perform certain tasks. For instance while you might still prefer to watch a movie on your tablet’s larger screen the Vision Pro can provide quick glances at messages or emails without having to pull out your phone. They’re particularly useful for situations where using your hands or looking down at a screen is inconvenient or unsafe such as when you’re cycling or carrying groceries.

How has innovations in AR glasses been pushed forward by the release of Apple Vision Pro?

The release of the Apple Vision Pro has undoubtedly accelerated innovation in the AR glasses sector. Apple’s reputation for high-quality user-friendly products means that their entry into this market has raised expectations for what smart glasses can do. The Vision Pro’s sophisticated design and functionality have encouraged competitors to push the boundaries of their own AR technology. Moreover developers are now more incentivised to create apps and experiences tailored to AR wearables knowing there’s a high-quality platform available that can support more complex and engaging augmented reality experiences.

What do reviews generally say about the user experience of the Apple Vision Pro?

Reviews of the Apple Vision Pro have been largely positive with many users praising its intuitive interface and ease of use. Critics have highlighted how the glasses feel natural to wear with notifications and information appearing unobtrusively in the wearer’s line of sight. The device’s lightweight design has also received commendations making it comfortable for extended wear. Users have expressed appreciation for the customisation options available allowing them to tailor their experience to their preferences and needs. While there is always room for improvement such as expanding the app ecosystem the consensus is that Apple has delivered a compelling product that enhances how we interact with technology.

Conclusion

After an in-depth exploration of the Apple Vision Pro it’s clear that these smart glasses are a leap forward in augmented reality wearables. The Apple Vision Pro review highlights its cutting-edge smart glasses technology seamlessly integrating with our daily lives. The innovations in AR glasses have been redefined by Apple’s smart eyewear offering users an unparalleled experience. Don’t miss out on the opportunity to elevate your tech wardrobe; experience the future of augmented reality by getting your hands on the Apple Vision Pro today.

Technology

The Age of Generative Photography in Art: Transforming Pixels into Masterpieces

In an era where technology continually pushes the boundaries of human creativity, the art world has embraced a groundbreaking transformation: Generative Photography. This fusion of art and artificial intelligence has given rise to a new form of artistic expression, enabling artists to harness the power of algorithms and machine learning to create breathtaking visual masterpieces. In this blog post, we’ll delve into the age of Generative Photography in art, uncovering its potential, applications, and how it’s reshaping the art landscape.

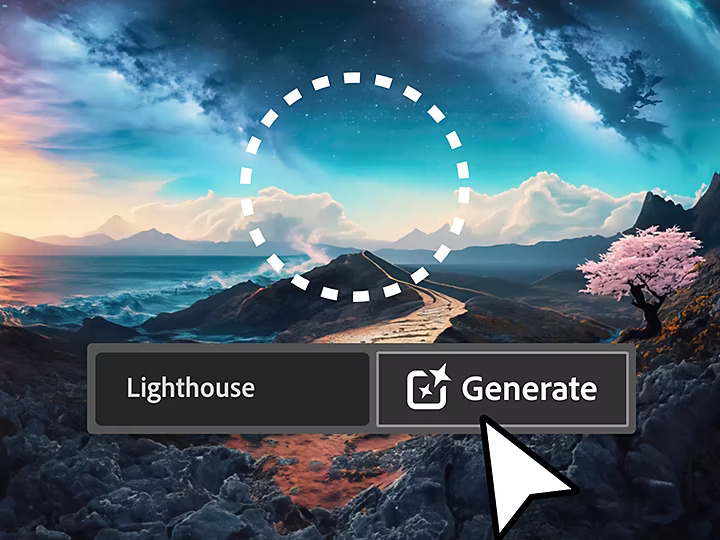

Understanding Generative Photography

Generative Photography is a revolutionary concept that marries the artistic vision of photographers with the computational prowess of AI. This new-age technique goes beyond conventional photography by allowing artists to generate, manipulate, and enhance images using algorithms and machine learning. It’s not about replacing the artist’s eye, but enhancing their creative potential.

The Role of AI in Generative Photography

At the heart of Generative Photography lies AI-driven algorithms, which analyze vast datasets to create realistic and imaginative visuals. These algorithms can mimic artistic styles, enhance images, and even generate entirely new compositions. With the help of deep learning, they can identify patterns, understand visual elements, and recreate them with precision.

Applications in the Art World

Generative Photography has found its place in various art forms, from traditional photography to digital art and beyond. Artists are using it to:

1. Artistic Enhancements

Generative Photography enables artists to take an existing image and apply unique artistic filters, styles, and effects. It allows for the creation of one-of-a-kind visual experiences.

2. Artistic Collaboration

Artists are now collaborating with AI systems, working together to produce stunning pieces that merge human creativity with machine precision. The results are often nothing short of extraordinary.

3. Creative Exploration

Generative Photography encourages artists to push their creative boundaries. It serves as a tool for exploration, providing endless possibilities and room for innovation.

The Impact on Artistry

Generative Photography is not just about automation but fostering creativity. It opens doors for artists to experiment and create like never before. Here are some ways it’s impacting the art world:

Unleashing Creativity

Artists are no longer limited by the constraints of traditional photography. With AI as their ally, they can freely explore their imagination, adding unique dimensions to their work.

Breaking Boundaries

Generative Photography challenges the conventional notions of art, pushing the limits of what’s possible. It encourages artists to step outside their comfort zones and create art that surprises and captivates.

Preservation and Evolution

The combination of AI and artistry ensures that traditional and digital art forms are preserved while continually evolving. It’s an exciting era where the past meets the future.

The Future of Art

Generative Photography is still in its infancy, and its potential is boundless. As technology advances and AI becomes more sophisticated, we can expect to see even more groundbreaking developments in the art world.

Art for All

Generative Photography has the power to make art more accessible to the masses. As AI-driven art tools become user-friendly, anyone can explore their artistic side and create stunning visuals.

The Marriage of Tech and Tradition

This revolutionary technique harmonizes technology and tradition, bridging the gap between generations of artists. It’s a testament to the ever-evolving nature of art.

Embracing Change

In an age where change is constant, Generative Photography offers artists a way to adapt, innovate, and thrive in the evolving landscape of art.

Conclusion

Generative Photography is a game-changer in the world of art. It combines the artist’s vision with AI’s computational might to unlock uncharted creative possibilities. This transformative approach not only enhances traditional art but also ushers in a new era of digital artistry. As we move forward, it will be fascinating to witness the art world’s continued evolution through the lens of Generative Photography.

-

Gaming4 years ago

Download Grand Theft Auto V Reloaded (Ultimate Repack)

-

Gaming4 years ago

Make Custom Fortnite Skin in 6 easy steps

-

Cryptocurrency4 years ago

Are Bitcoin Transactions Anonymous? Everything Explained

-

Gaming4 years ago

Top 7 Games You Can Play With Intel HD 5500, 8GB of RAM, and an Intel i5 Processor

-

Technology3 years ago

What Is Quickbooks Online – Top Benefits of the Software Package

-

Technology3 years ago

Email Archiving Open Source – What You Must Learn

-

Cryptocurrency4 years ago

What is The Name of the General Ledger that Tracks all Bitcoin Transactions?

-

SEO & Marketing3 years ago

How to Convert Website Traffic into Qualified Leads using Fastbase and Google Analytics